When considering investing in the stock market, you can decide between two main paths: long-term investing or stock trading. While both strategies involve buying and selling stocks, they differ in terms of time horizon, objectives, and execution.

Join us in this blog as we examine the benefits and drawbacks of long-term investing and stock trading. We’ll provide valuable insights and examples to assist you in selecting the approach that suits your financial objectives.

Long-term investing or stock trading: Choosing the Right Approach for Wealth Creation

What is Long-Term Investing?

When you choose long-term investing, you aim to hold onto stocks for a significant duration, often spanning many years or even decades.

The objective is to generate wealth through capital appreciation and dividends over time. Long-term investors prioritize fundamental analysis, researching the company’s financials, industry position and long-term prospects.

Long-term investors aim to identify undervalued stocks with growth potential and hold them through market fluctuations.

Example of Long-Term Investing in RIL

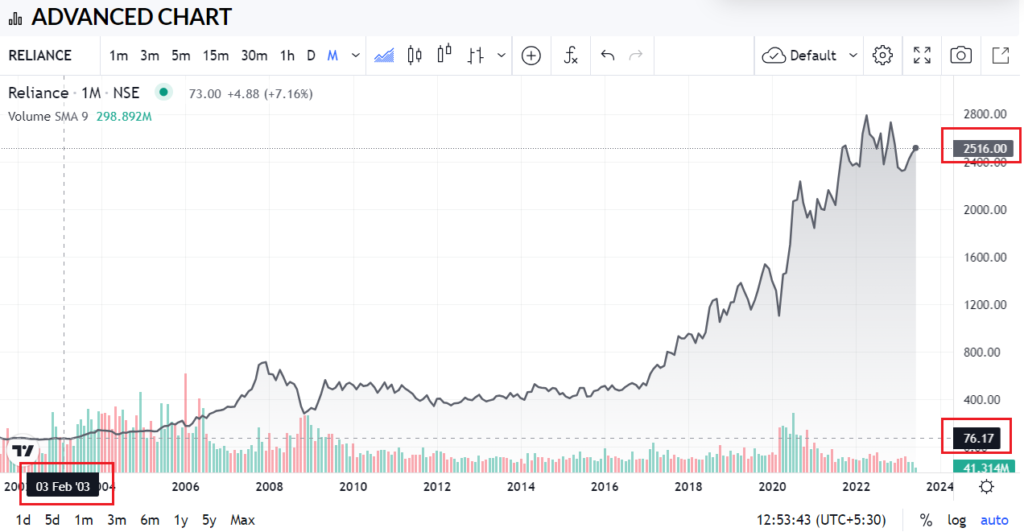

Here is the long-term chart of RIL.

The impressive growth of RIL’s share price from around Rs. 76 in February 2003 to approximately Rs. 2500 has delivered significant long-term gains to investors. This rise in share price reflects the company’s growth and performance over the years.

Investors who held RIL shares for the long term have potentially experienced significant capital appreciation. By choosing long-term investments, investors can use compounding, where their investment grows steadily over time.

Pros of Long-Term Investing

1. Less Time-Intensive: Long-term investing requires less active monitoring and allows for a more passive approach to wealth creation.

2. Potential for Compound Growth: Long-term investors can benefit from the compounding effect, as returns reinvested over time can create significant wealth.

3. Reduced Trading Costs: Fewer trades translate to lower transaction costs, saving expenses in the long run.

What is Stock Trading?

Stock trading revolves around buying and selling stocks within shorter timeframes, as investors aim to exploit short-term price fluctuations for potential profits.

Traders use technical analysis, focusing on charts and market trends, to make buying and selling decisions.

Stock traders aim to profit from short-term price movements, seeking opportunities in rising and falling markets.

Example of Stock Trading in RIL

Here is the one-day chart of RIL.

Suppose a stock trader noticed that the share price of Reliance Industries Limited (RIL) made a low of Rs. 2455.99. Recognizing the potential for a price rebound, the trader decided to execute a short-term trade. They purchased RIL shares at the low price of Rs. 2455.99, anticipating the price would increase shortly.

After a few hours of buying shares, they observed that the price had increased to around Rs. 2512.65. Recognizing this as a favourable opportunity, the trader decided to sell their RIL shares at a higher price, profiting from the short-term price movement.

In this example, the stock trader engaged in stock trading by capitalizing on the short-term price fluctuations of RIL shares.

Pros of Stock Trading

1. Potential for Quick Profits: Stock traders aim to profit from short-term price fluctuations and can potentially generate quick returns.

2. Leveraging Market Volatility: Stock traders can use market volatility to generate profits through upward and downward price movements.

Cons of Stock Trading

1. Time-Intensive and Emotionally Demanding: Active monitoring, analysis, and decision-making require a substantial time commitment and can lead to emotional stress.

2. High Risk and Volatility: Stock trading involves higher risks due to short-term market volatility and unpredictable price movements.

Final Words:

Deciding between long-term investing or stock trading depends on individual preferences, risk tolerance and financial goals. Long-term investing offers the potential for steady, compounding growth, while stock trading provides opportunities for quick profits but involves higher risks and demands more active involvement.

It is crucial to assess your financial objectives, risk appetite and available time before choosing the approach that suits you best.

Adopting a hybrid strategy, combining long-term investing for core holdings with occasional stock trading for short-term opportunities may also be possible.

Note: We recommend you contact your financial advisor before carrying out specific transactions and investments.