Investing in mutual funds provides an excellent avenue for wealth accumulation and realizing your financial goals. However, determining the ideal amount to start investing can be challenging. In this blog, we will explore the factors that influence the ideal investment amount in mutual funds.

Importance of Setting an Investment Threshold

Setting an investment threshold is crucial as it helps you determine the initial amount to allocate towards mutual funds. It establishes a starting point and allows you to take advantage of the potential returns offered by mutual fund investments. Although there is no universal solution, taking certain factors into account can assist you in determining an optimal amount that aligns with your financial circumstances and objectives.

Factors To Be Considered Before Investing in mutual funds

- Your Earnings: Your income is a key factor in determining the ideal investment amount. It’s advisable to allocate a percentage of your earnings towards investments. Consider your disposable income after accounting for essential expenses and allocate a portion for mutual fund investments.

- Financial Goals: Identify your financial goals, ensuring you consider both immediate and future objectives. Whether it’s buying a house, funding education, or planning for retirement, determine the investment amount required to achieve those goals. Your financial goals will guide you in setting the right investment threshold.

- Risk Appetite: Assess your risk tolerance, which is your comfort level with market fluctuations and potential losses. Higher-risk investments may require a larger investment amount, while lower-risk options may allow for smaller initial investments. Align your investment amount with your risk appetite.

- Investment Time Horizon: Consider the duration you are willing to invest for. Longer time horizons provide more opportunities for compounding growth and may require smaller initial investments. Shorter time horizons may necessitate a higher investment amount to meet your goals within a limited timeframe.

- Diversification: Evaluate your desire for diversification across multiple mutual funds or asset classes. Diversification spreads risk and enhances potential returns. If you aim to diversify, you may need a higher investment amount to allocate across various funds or investment options.

- Regular Contributions: Systematic Investment Plans (SIPs) allow you to make regular contributions to mutual funds. Starting with a smaller initial investment amount and gradually increasing contributions over time is a viable strategy. SIPs enable disciplined investing and make it easier to enter the market.

- Personal Financial Situation: Consider your overall financial situation, including expenses, debts, emergency funds, and expenditure patterns. Take the time to evaluate your monthly expenses and develop a clear understanding of your financial responsibilities This will help you determine the ideal investment amount that fits within your budget.

Example of the Financial Goals of Rajesh

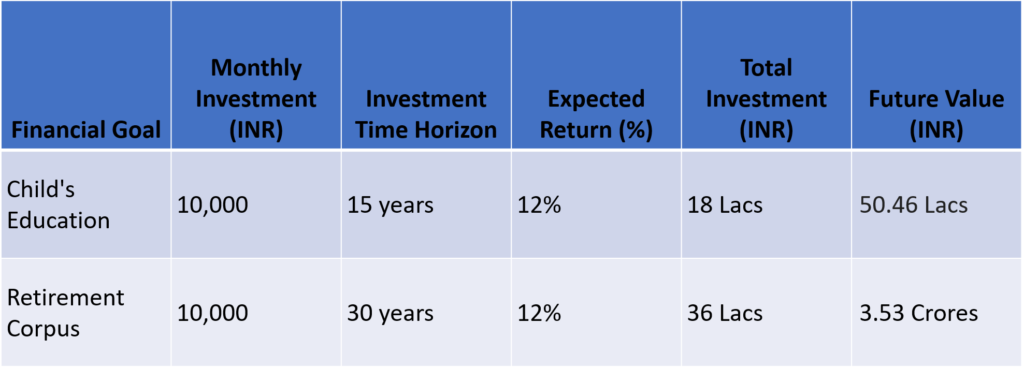

Let’s consider the example of Rajesh, an individual with two different financial goals. Rajesh aims to save for his child’s education fund and build a retirement corpus.

Rajesh has a moderate risk appetite and a time horizon of 15 years for his child’s education and 30 years for retirement. After assessing his financial situation, Rajesh decides to allocate Rs. 20,000 per month towards mutual fund investments.

Out of this amount, he allocates Rs. 10,000 per month towards an equity mutual fund for long-term growth potential, supporting his child’s education fund. The remaining Rs. 10,000 per month is allocated towards a balanced mutual fund that offers a mix of equity and debt for stability and regular income, contributing to his retirement corpus.

Summary of Financial Goals of Rajesh

Rajesh plans to increase his investment amount annually as his income grows. By starting early and consistently investing in mutual funds, he aims to benefit from the power of compounding and achieve his financial goals.

Final Words

To sum up, the ideal amount for investing in mutual fund investments is unique to each individual and has no universal standard. It should be emphasized that the investment amount is subjective and dependent on a multitude of factors unique to each person.

It depends upon factors such as your income, financial goals, risk tolerance, investment time horizon, diversification needs, regular contributions, and personal financial situation. Each individual has unique circumstances and objectives that influence their investment decisions.

By evaluating these factors and seeking the guidance of financial experts, you can make informed choices while investing in mutual funds that position you for a successful investment journey. Remember, investing is a personalized journey, and the ideal amount may vary for each individual.