In our country, people who are getting older worry about having enough money. So, the Indian government made a plan called Atal Pension Yojana (APY). It’s mainly for people who work in an unorganised sector, like office jobs or house helpers. Starting in 2015, the APY is a security plan meant to give regular income to people who work when they’re no longer working.

Understanding Atal Pension Yojana (APY)

Atal Pension Yojana (APY) is a government-backed pension scheme launched by the Government of India on May 9, 2015. It’s created for people working in the unorganised sector without a proper pension system. This plan is for people aged 18 to 40. It allows them to contribute to a pension fund.

Key Features of Atal Pension Yojana (APY)

- Age Criteria: APY is open to individuals aged 18 to 40. It ensures that the working population has sufficient time to build a substantial corpus for retirement.

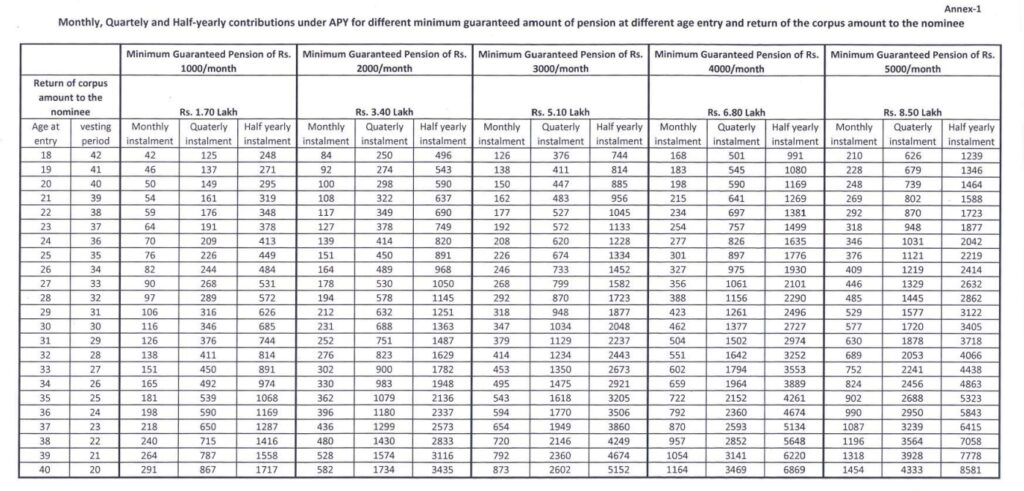

- Contributions: The scheme requires regular contributions from the participants, which can be as low as ₹42 to ₹1,454 per month, depending on the chosen pension amount and the individual’s age when joining the scheme.

- Pension Options: APY offers fixed pension options ranging from ₹1,000 to ₹5,000 per month. Participants can choose a pension amount based on their financial goals and requirements.

- Guaranteed Pension: One of the advantages of APY is that it provides a fixed pension amount for the rest of the participant’s life. It ensures you’ll have money regularly when you retire.

- Nomination Facility: Participants can nominate a family member who will receive the accumulated corpus and pension in case of the participant’s unfortunate demise.

Benefits of Atal Pension Yojana (APY)

- Financial Security: With APY, you can count on a steady income during retirement, so you don’t have to depend as much on your family.

- Affordability: The scheme’s flexible contribution options ensure that even small-income people can participate and secure retirement.

- Government Support: With the government supporting and guaranteeing the plan, it becomes a reliable choice for those who might want to take part.

- An incentive for early enrollment: Joining the scheme at an earlier age results in lower contribution amounts, making it advantageous for young individuals to plan for their retirement from an early stage.

- Tax Benefits: The contributions made towards APY are eligible for tax benefits under Section 80CCD of the Income Tax Act, providing additional financial relief.

Enrolment Process for Atal Pension Yojana (APY)

The enrolment process is straightforward. Interested individuals can approach their bank or post office to open an APY account. For a seamless enrolment experience, the participant must have a savings bank account, an Aadhaar card, and a mobile number linked to their bank account.

FAQs on Atal Pension Yojana (APY)

1. What is a pension? Why is it required?

A pension is a monthly income you get when you’re not working anymore. It helps you have money to live on even when you’re not earning. Reasons to have a pension:

- People earn less as they get older.

- Things cost more, so you need more money to live.

- People are living longer.

- Having a fixed amount of money each month helps you live a dignified life when you’re old.

2. What is Atal Pension Yojana?

Atal Pension Yojana (APY) is a plan for people in India. It’s mainly for those who work in the unorganised sector. With APY, you pay a small amount regularly, and you will get a certain amount every month when you’re 60 years old. The pension amount depends on how much you’ve paid into the plan.

3. Who can join APY?

Any person in India can join APY. Here are the rules:

- Your age should be between 18 to 40 years.

- You need to have a savings bank account or a post office savings bank account.

- You can provide your Aadhaar number and mobile number when you sign up. However, providing an Aadhaar number is not mandatory if you decide not to.

4. How much pension will I get with APY?

When you’re 60 years old, you’ll start getting a monthly pension. The amount depends on how much you’ve put into the plan. You’ll receive at least Rs 1,000, 2,000, 3,000, 4,000, or 5,000 monthly as your pension amount.

5. How do I start an APY Account?

Here’s how you can start your APY Account:

- Go to the bank branch or post office where you have your savings account. If you don’t currently have one, open a savings account.

- Give your bank account number or post office savings account number. The bank staff will help you fill out the APY form.

- You can also provide your Aadhaar number and mobile number. You’re not obligated to do so, but it makes communication about your contributions more transparent.

- Ensure your savings account or post office savings account holds enough money. This money will be used for your contributions every month, every three months, or every six months.

6. Do I need an Aadhaar Number to join APY?

You don’t have to give your Aadhaar number to open an APY account. But it’s a good idea to share it so they know it’s you.

7. Can I start APY without a savings bank account?

No, you don’t have to have a savings bank account or post office savings bank account to join APY.

8. Can I open more than one APY account?

No, you can only open one APY account. It’s unique, and you can’t have more than one.

9. How does the withdrawal process work for APY?

A. Upon reaching the age of 60 years:

- Once the subscriber turns 60, they can request the associated bank to provide them with the minimum guaranteed monthly pension or a higher one if the investment returns exceed the guaranteed returns of APY.

- If the subscriber passes away, the same monthly pension will be given to the spouse (default nominee).

If both the subscriber and spouse pass away, the nominee can receive the pension funds accumulated until the subscriber reaches the age of 60.

B. In the case of the subscriber’s demise after the age of 60 years:

- If the subscriber passes away, the spouse will receive the pension.

- If both the subscriber and spouse pass away, the pension wealth accumulated until the subscriber’s age of 60 will be returned to the nominee.

C. Exiting before the age of 60 years:

- Exiting before 60 years is generally not allowed, except in some circumstances approved by PFRDA, such as the beneficiary’s death or a terminal illness.

- Suppose a subscriber who received government co-contribution leaves APY voluntarily in the future. In that case, they will only receive their contributions to APY along with the actual earned income on those contributions (minus account maintenance charges).

- The government co-contribution and its earned income will not be refunded to such subscribers.

D. Subscriber’s demise before the age of 60 years:

- If the subscriber dies before turning 60, the entire accumulated corpus under APY will be given to the spouse or nominee. However, the spouse or nominee will not receive the pension payments.

Final Words

Atal Pension Yojana is more than just a plan; it’s a vow from the government to safeguard the future of those working in the unorganised sector. By encouraging individuals to save systematically for retirement, APY empowers them with financial freedom during their golden years. As more and more people in India realise how necessary retirement planning is, Atal Pension Yojana becomes a beacon of hope, leading the way to a retirement life that’s steady, honourable, and self-sufficient.