In a country where money isn’t equally distributed, the government must provide cheap insurance and help everyone feel financially protected. The Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a way for the Indian government to ensure everyone’s protection. They want each person to live without financial troubles when accidents happen unexpectedly.

Jan Suraksha Initiative: Empowering the Masses Through Financial Inclusion

- PMSBY, a flagship social security scheme under the Jan Suraksha initiative, aims to provide accidental death and disability insurance coverage to economically vulnerable population segments. Because it has a small price to pay and an easy way to join, the plan aims to remove the problems that stop people in rural and less privileged areas from getting insurance.

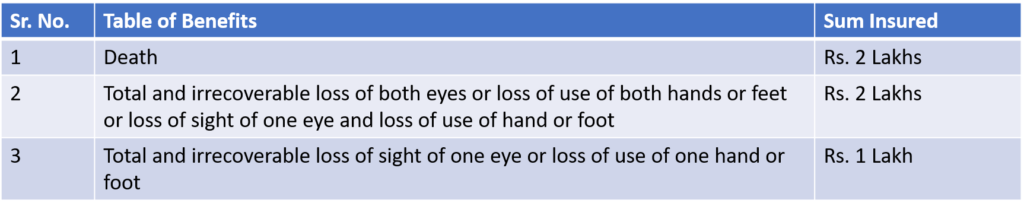

- Insurance coverage is accessible to qualified individuals through a yearly premium of Rs. 20. In the unfortunate event of accidental death or lasting disability, the coverage extends to Rs. 2 lakhs. Moreover, for instances of permanent partial disability, coverage of up to Rs. 1 lakh is provided.

Key Features and Benefits – Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Affordability: One of the standout features of PMSBY is its affordability. Since the premium is low, the government wants more people from different parts of society to use the scheme’s benefits.

- Easy Enrollment: The scheme’s enrollment process ensures that individuals from all walks of life can quickly sign up. The enrollment period typically falls between June 1st and May 31st.

- No Medical Examination: PMSBY does not mandate health check-ups, unlike many insurance policies. It removes a big hurdle that could keep individuals with health conditions from being able to join.

- Comprehensive Coverage: PMSBY’s insurance coverage is broad and includes accidents in all settings—at home, on the road, at work, or during travel. This extensive coverage makes it an attractive option for individuals seeking comprehensive financial protection.

- Direct Bank Debit: The premium is debited from the enrolled individual’s bank account, making the process seamless and hassle-free.

- Renewal Option: PMSBY’s renewal process is automatic, provided the bank account from which the premium is being debited remains active. This feature ensures that beneficiaries continue to enjoy the scheme’s benefits without interruption.

Impact on the Masses of Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Tangible Financial Relief: PMSBY has offered substantial financial relief to families during accidents, easing the burden of unforeseen medical costs and income loss.

- Peace of Mind: Beneficiaries gain peace of mind, knowing they have a safety net to fall back on during unexpected accidents.

- Financial Awareness: The scheme promotes financial awareness and preparedness, fostering participants’ more secure economic future.

- Improved Social Well-being: PMSBY enhances the overall well-being of families, preventing financial distress due to accidents.

- Cultivating Responsibility: Beneficiaries become more responsible for their financial security, encouraging a culture of self-protection.

FAQs – PRADHAN MANTRI SURAKSHA BIMA YOJANA (PMSBY)

Q1. What’s this scheme all about?

This scheme is a Personal Accident Insurance Scheme. It provides coverage for one year and is renewable every year. It protects in case of an accident that leads to death or disability.

Q2. What benefits do I get from the scheme, and how much do I need to pay?

Here’s what you get if an accident happens:

You pay a premium of ₹20 per year.

Q3. What’s meant by an “accident”?

An accident is when something sudden and unexpected happens because of something outside, like a strong force you can see.

The premium will be taken from your bank or post office account automatically.

Q5. Who can subscribe to this scheme?

You can join between 18 and 70 and have an individual or joint bank/post office account. Even if you have accounts in multiple banks/post offices, you can only join through one.

Q6. When and how can I enrol?

You’ll be covered for one year, from June 1st to May 31st. To join, you need to fill out a form and choose to pay ₹20 per year from your bank/post office account. If the amount changes, they’ll tell you. If you sign up after this date, you can still join by paying the premium.

Q7. Can I join later if I don’t join initially?

If you’re eligible, you can join by paying the premium automatically from your account in the coming years. But remember, your coverage will start only when the premium is paid.

Q8. If someone leaves the scheme, can they join again?

You can if you leave the scheme and want to join again later. But you must pay the annual premium and follow any conditions set. Your coverage will start when the premium is taken from your account.

Q9. When does the accident cover stop?

The accident cover will stop or change in these situations:

- i. When you turn 70 years old.

- ii. If you close your bank account or don’t have enough money to pay for insurance.

- iii. If you have insurance through multiple accounts and pay extra by mistake, only one account’s insurance will be valid, and the extra money won’t be returned.

Q10. Is this coverage in addition to other insurance schemes?

Yes.

Q11. Does PMSBY cover natural disasters like earthquakes and floods? What about suicide or murder?

Yes, if the disaster causes death or disability, it’s covered. PMSBY doesn’t cover suicide, but it covers murder.

Q12. Can all joint account holders join through that account?

Yes, if everyone in the joint account is eligible, they can join and pay ₹20 each per year.

Q13. Which bank accounts can join PMSBY?

All bank account holders, except institutions, can join.

Q14. Can NRIs get coverage?

Yes, if they have an eligible Indian bank account. But claims will be in Indian currency.

Q15. Does PMSBY cover hospital expenses?

No.

Q16. Who gets the benefit if the account holder dies?

The nominee or legal heir can claim it as per the enrollment form.

Q17. How is the claim amount paid?

Disability goes to the account holder, and death goes to the nominee or legal heir.

Q18. Does suicide get insurance benefits?

No.

Q19. Do accidents need to be reported to the police for claims?

Yes, for incidents involving vehicles, crime, or drowning. For others, immediate hospital records are needed.

Q20. What if someone is missing and presumed dead?

PMSBY only covers confirmed accidental deaths with proof.

Q21. What if someone has a partial disability without loss of sight or limb?

No benefits are paid.

Q22. Can someone claim from multiple banks they joined?

No, only one claim is allowed per person.

Final Words

Insurance is now within reach with the scheme and doesn’t cost much, so many people feel more secure and prepared.

While India moves ahead in its development journey, the PMSBY is a sign of hope. It demonstrates that even simple plans can matter to lots of people.